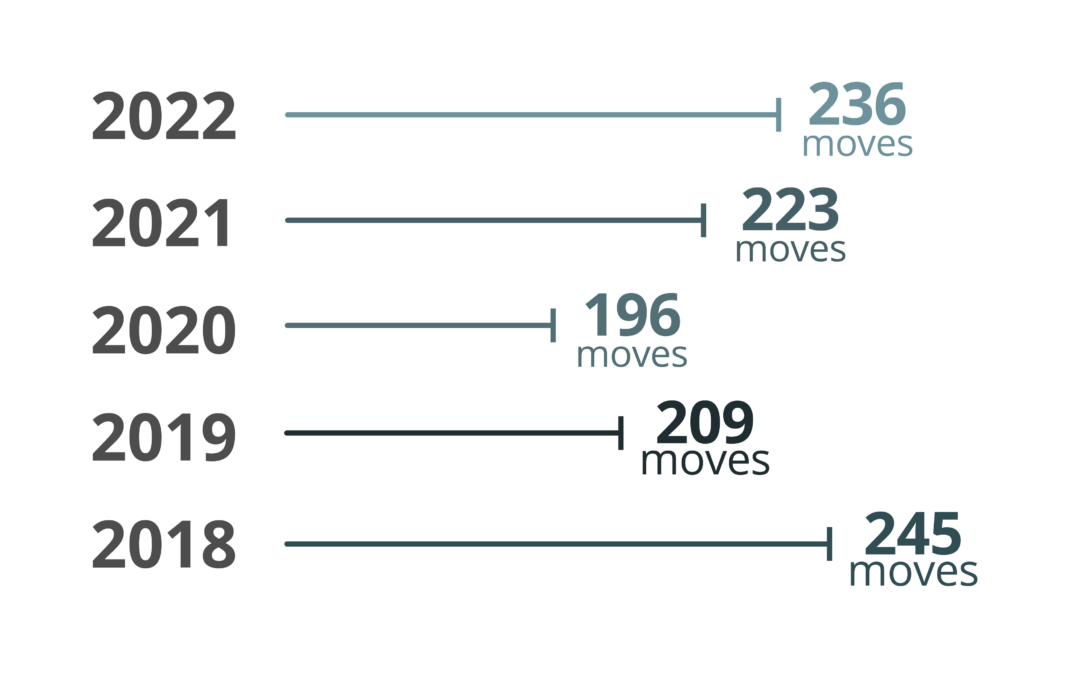

Highlights for Texas 2022: office openings slow in 2022; most active Q4 in five years; Dallas still on top; Commercial Litigation tops list, swapping with Corporate M&A Securities; a note on associate layoffs

WHAT WE’RE SEEING

Office Openings Slow: The past few years have seen a flurry of office openings, with non-Texas-based firms expanding into Texas. We still saw six new entrants into the market in the first half of 2022, but only one new opening (McDermott in Austin) in the back half of the year.

With the market naturally growing more saturated, and following the down-trending real estate market, we expect this slowed pace to continue into 2023

Most Active Q4 in 5 Years: In raw numbers, the fourth quarter’s 45 partner moves was the highest we’ve seen in the five years we’ve been tracking.

Typically, Q4 has accounted for just 12-14% of annual moves. However, in both 2021 and 2022, this number climbed to 19%.

Dallas Still on Top for Third Year: Every year we’ll see some jockeying between Dallas and Houston for the city drawing the most moves. But for 2022, as well as the two years prior, Dallas managed to nab the top spot.

Austin came in a distant 3rd, while only three other cities — Fort Worth, San Antonio and Waco — managed to register at all.

Commercial Litigation Overtakes Corporate M&A Securities: As predicted, Corporate M&A Securities moves have slowed this year. In fact, it has exactly swapped places with Commercial Litigation, which increased its share of partner moves this year by 11 points, while Corporate M&A Securities dropped by 11 points.

Intellectual Property and Energy & Infrastructure practice area moves both increased by 5 percentage points over 2021.

To see the complete newsletter, with data and analysis for this quarter, click the button below.

LIST OF TEXAS PARTNER MOVES: Q4 OF 2022

Sign up to get our quarterly newsletters tracking partner moves and hiring trends.

Privacy Policy: We do not share or sell consumer personal information including email addresses or mobile information to third parties for marketing/promotional purposes. All other categories exclude text messaging originator opt-in data and consent; this information will not be shared with any third parties