Newsletter

Whether you’re a partner looking to take your career to the next level or a law firm seeking out the best talent, there’s a good chance you won’t achieve the success you’re hoping for without a plan based on a comprehensive and current understanding of the market. With the Aspire newsletters, our aim is to provide you with information and analysis that will inform more strategic decisions.

We have two newsletters we send once a quarter, one following lateral partner moves to Am Law 100 firms nationally and another following moves throughout firms in Texas. In each newsletter, we include a list of partner moves, a few graphics and quick notes to distill the newsworthy hiring trends we’re seeing.

Keep reading to learn about this quarter’s goings-on!

Sign up to get our quarterly newsletters, tracking partner moves and hiring trends throughout the legal industry.

2025 National Newsletter Q1 Recap

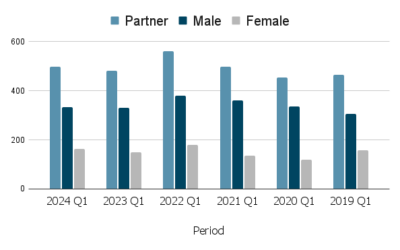

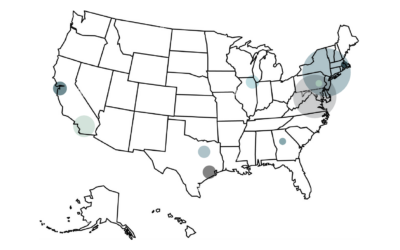

Q1 2025 Highlights for Am Law 100: 565 total partner moves; most active Q1 of the past five years; New York, D.C., L.A., Chicago, San Francisco, Atlanta - most active markets in Q1; partners with 10 - 20 years experience most active WHAT WE'RE SEEING MOST ACTIVE...

2024 National Newsletter – End Of Year Recap

2024 Highlights for Am Law 100: Highlights for Am Law 100 2024: most active year since 2022; New York, D.C., L.A., Chicago, Houston - most active markets in 2024; Q1 & Q2 most partner moves; partners with 10 - 20 years experience most active.WHAT WE'RE SEEING 2024...

2024 National Newsletter – Q3 Recap

Q3 2024 Highlights for Am Law 100: 465 moves total; most partner moves occurred in August; most active markets: NYC, D.C., Chicago, Houston & Philadelphia; partners from the class of 2012 had the most moves. WHAT WE'RE SEEING 2024 Q3 MOVES ARE DOWN 10 PERCENT...

2024 National Newsletter – Q2 Recap

Q2 2024 Highlights for Am Law 100: 513 moves total; most partner moves occurred in April; most active markets: NYC, D.C., Boston, L.A. & Chicago; partners from classes of 2011 & 2013 had the most moves. WHAT WE'RE SEEING 2024 Q2 MOVES ARE UP 18 PERCENT...

2024 National Newsletter: Q1 Review

Q1 2024 Highlights for Am Law 100: 498 moves total; most partner moves occurred in March; most active markets: NYC, D.C. L.A., Chicago, Houston; partners from class of 2006 had the most moves. WHAT WE'RE SEEING 2024 Q1 WAS SLIGHTLY MORE ACTIVE THAN 2023:...

2023 NATIONAL NEWSLETTER: YEAR-END REVIEW

Highlights for Am Law 100 2023: steady moves all year; New York, D.C., L.A., Chicago, San Francisco - most active markets; Q1 most partner moves; partners with 10 - 15 years experience most active. WHAT WE'RE SEEING MARCH WAS THE MOST ACTIVE MONTH: March was the most...

2023 NATIONAL NEWSLETTER MID-YEAR REVIEW

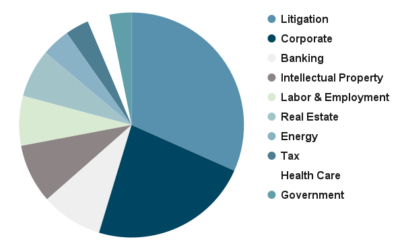

Highlights for Am Law Mid-Year 2023: healthy first half of 2023 with 896 moves; Litigation edges out Corporate M&A Securities for the top practice area; Lewis Brisbois nabs 27 Litigation partners…

2022 Q4 Texas Newsletter: Reflecting on 2022

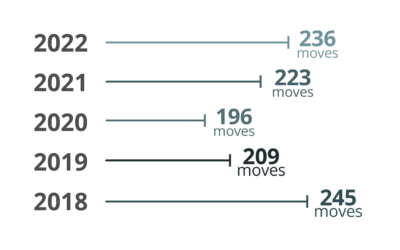

Highlights for Texas 2022: office openings slow in 2022; most active Q4 in five years; Dallas still on top; Commercial Litigation tops list, swapping with Corporate M&A Securities; a note on associate layoffs…

2022 Q4 National Newsletter: Reflecting on 2022

Highlights for Am Law 2022: robust movement in Q4; D.C., Houston, Chicago steadiest top markets; Corporate M&A Securities top practice area but slowing; Greenberg Traurig, Holland & Knight tie scoring 65 partner moves each…

2022 Q3 National Newsletter: Everyone Getting Piece of the Pie

Highlights for Am Law Q3 2022: partner moves more evenly split across practice areas; Texas claims three spots in top 10 markets while the coasts slip; everyone getting a piece of the Corporate M&A Securities pie in Q3…

2022 Q3 Texas Newsletter: Slight Drop in Lateral Moves

Highlights for Texas Q3 2022: comeback for Texas-based firms; record-low August; Corporate M&A Securities yields just 3 moves…

2022 Q2 Texas Newsletter: Surprising Pause Despite Demand

Highlights for Texas Q2 2022: surprising pause for second quarter; non-Texas-based firms increase share; Houston, Dallas and Austin growing concentration of lateral moves…

2022 Q2 National Newsletter: Market Active Now, What About the Future?

Highlights for Am Law Q2 2022: Corporate M&A Securities most active practice group; Banking & Finance practice area moves into top 3; Houston and Boston markets gain momentum; Holland & Knight snags most Corporate M&A Securities partners…

Introducing New National Tracker for Lateral Partner Moves

Aspire has been tracking lateral partner moves to Am Law 100 firms across the country and now we’re sharing that information with you! Look for this newsletter each quarter and visit our website to search the running list of partner moves…

2022 Q1 Newsletter: Potential for Record-Breaking Year

Highlights for the first quarter of 2022: near record-breaking quarter; lateral moves going to non-Texas-based firms jumps to 76%; five new office opens; Energy & Infrastructure gaining steam…

2021 Q4 Newsletter: Reflecting on 2021

Highlights for 2021: record breaking Q4, returning to pre-pandemic levels; M&A accounted for 1 in 4 moves; Texas-based Jackson Walker tallied most moves in 2021; 10 firms entered Texas market last year, 6 in Austin; Houston's share of moves declined, Austin...

2021 Q3 Newsletter: Steady as She Goes

Highlights for the third quarter of 2021: partner moves robust and level; elite firms making presence known; Austin still drawing talent after office opens; 8 errors when recruiting talent…

2021 Q2 Newsletter: Austin’s Magnetism

Highlights for the second quarter of 2021: Austin making big gains; firms are interested but partners staying put; Texas-based firms dwindle; Aspire expands to Denver…

2021 Q1 Newsletter: Leveling Out

Highlights for the first quarter of 2021: moves drop as firms respond to external uncertainty; February storm freezes hires; health care practice area surges; nearly all moves split between DFW and Houston…

2020 Q4 Newsletter: Reflecting on 2020

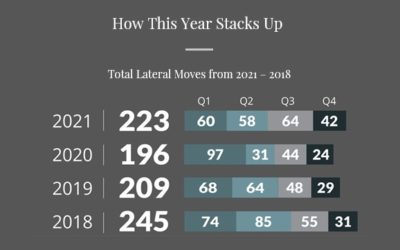

Highlights for 2020: phenomenal Q1 open; back half of the year nearly on par with 2019; M&A movement dominated; Dallas market heavily favored; a look back at recent years…

2020 Q3 Newsletter: Still Bullish on Texas

Highlights for the third quarter of 2020: non-Texas-based firms pick up the pace; pandemic not really reflected in practice area hires; Houston making noise with office opening; comparing year-over-year shows bullish Texas market…

2020 Q2 Newsletter: What does the future hold?

Highlights for the second quarter of 2020: several groups are weathering the storm better than others, including native Texas firms, middle market firms and the Dallas market; pent-up lateral hires in second half of 2020 could result in more moves than 2019…

2020 Q1 Newsletter: Act Now or Wait and See

Highlights for the first quarter of 2020: huge start to Q1 outpacing 2019 and 2018; more M&A partner moves than all of last year; Dallas keeps hot streak with new office openings; now isn’t the time for “wait-and-see”…

2019 Q4 Newsletter: 100 Attorneys

Highlights for 2019: Texas remains strong despite drop in overall partner movement; non-Texas-based firms netted 66% of moves; Houston and Dallas dominated statewide market; Corporate Litigation moves hot, no sign of cooling…

2019 Q3 Newsletter: Hiring Post-Merger

Highlights for the third quarter of 2019: partner moves leveling off after 2018 new office boom and subsequent slow down; smaller markets getting squeezed out of the attorney race; a look at two Texas firms 18 months post merger and their potential to start attracting talent in 2020…

2019 Q2 Newsletter: Siren Song of National Prestige

Highlights for the second quarter of 2019: partner moves on the rise after sluggish spring; Houston regaining attorney foothold following Dallas boom; Commercial Litigation movement remains active; and local Am Law firms continue losing talent to larger non-Texas-based and smaller Texas firms…

2019 Q1 Newsletter: Luring the M&A Lawyer

Highlights for the first quarter of 2019: the departures to out-of-state-based firms slowed; Houston is edging out Dallas in the attorney move count; March was particularly stagnant; and M&A is still the hottest ticket in town…